WHy Payment Links Get You Paid Faster in Business

In my experience navigating B2B transactions, I have discovered that payment links are not just another payment tool – they are a game changer. Businesses often struggle with delayed payments, high administrative overhead, and inefficient invoicing systems. Payment links, when integrated with NPSONE & ClickBillr, simplify receiving money by converting invoices into interactive, one‐click payment opportunities. In this article, I explain how these links work, outline their key benefits and real‐world applications, and discuss their seamless integration with accounting software and clickbillr. I also cover the robust security and compliance measures that protect businesses using this modern payment method. By the end, you will understand how payment links contribute to optimized cash flow, faster payment turnaround, and enhanced customer experiences while supporting in B2B transactions.

This exploration offers actionable insights on how to implement and benefit from payment links in your business. I describe their definition, strategic integration with solutions like Nationwide Payment Systems and NPSOne, and how they reduce manual processing, errors, and recurring billing issues. In sectors where every day delay affects cash flow and bottom-line performance, payment links provide an optimal blend of efficiency and security. Let’s dive into the specifics.

How Payment Links Work

Payment links simplify the payment process by offering a direct and secure method for customers to pay online. When a customer clicks a payment link, they are directed to a secure page to enter their payment details—whether it’s credit card information, bank transfer data, or a digital wallet. Funds are then transferred directly to the seller, removing the need for physical invoices, manual data entry, or traditional processing methods like checks and ACH transfers.

Why Payment Links Are Essential for B2B Transactions

In business-to-business (B2B) settings, where payments often involve large amounts and detailed documentation, payment links provide a vital connection between invoicing and payment. They offer several key benefits:

Streamlined Process

Payment links automate the transition from invoice generation to payment confirmation. By embedding a single link in an email or website, businesses reduce administrative tasks and eliminate the need for manual follow-up.

Faster Payments and Better Cash Flow

Customers can pay instantly from any device, speeding up the payment cycle. This reduces days of sales outstanding (DSO) and lowers the risk of late or lost payments. For small businesses and startups, quicker access to funds strengthens liquidity and enables reinvestment.

Advanced Security and Compliance

Modern payment links use strong encryption, secure gateways, and follow industry standards such as PCI DSS. Features like multi-factor authentication and tokenization protect sensitive customer data.

Simplified Accounting and Reconciliation

Payment links integrate directly with accounting software, automatically updating records when a payment is received. This eliminates manual entry, reduces errors, and speeds up monthly and annual closing processes. Businesses gain real-time insight into their financial status.

Improved Customer Experience

For customers, payment links provide a straightforward, user-friendly interface that eliminates the need to recall banking details or navigate complex portals. This ease of use encourages prompt payments and builds stronger relationships.

Implementing Payment Links in Your B2B Strategy

To implement payment links successfully, businesses should focus on both technology and process:

Select the Right Provider

Choose a solution that integrates well with your existing systems, offers strong security, clear pricing, and reliable customer support.

Set Up in Accounting Software

Most modern platforms support payment links. You simply connect your bank account, apply your company branding to the payment page, and include the link in your invoices or automated emails.

Follow Best Practices

Include a clear call-to-action with each link—invoice number, due date, and payment amount. Consistent branding increases trust, and sending reminders with confirmation emails adds professionalism.

Use on Your Website

Placing payment links in customer portals or secure payment pages makes access even more convenient.

Comparing Payment Links to Traditional B2B Methods

Compared to ACH and wire transfers, payment links offer major advantages:

- Transactions are nearly instant, reducing payment cycles

- Lower processing fees, especially compared to wire transfers

- Reduced manual input and fewer errors thanks to automation

- Real-time integration with accounting platforms for better reporting

Recurring Payments and Broader Applications

Many platforms support recurring billing, ideal for subscriptions and long-term contracts. This boosts efficiency and provides predictable cash flow. Payment links can also work alongside other payment options like mobile wallets and bank transfers, creating a flexible and automated financial ecosystem.

Industry Impact

Businesses in sectors like SaaS, consulting, and manufacturing have seen measurable improvements using payment links: shorter payment cycles, reduced administrative overhead, better liquidity, and stronger cash flow

What Do Statistics Reveal About Payment Links and B2B Payment Trends?

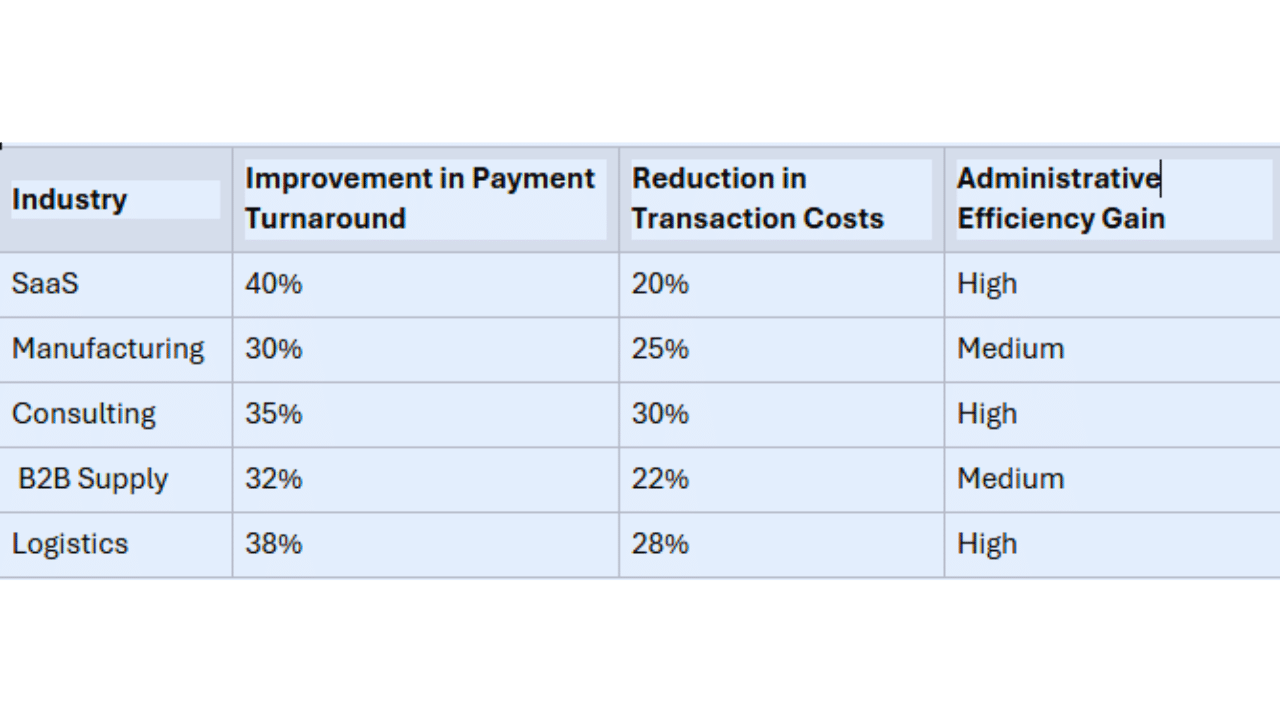

Surveys indicate that businesses using payment links experience improvements in payment turnaround times by approximately 35% and reductions in transaction costs by 25%. Additionally, there is a notable decrease in administrative workload. The table below summarizes these real-world benefits:

Security and Compliance

Payment link providers invest in strong safeguards to protect financial data:

- Encryption & Tokenization secure information during transactions.

- Fraud Detection continuously monitors and blocks suspicious activity.

- Multi-Factor Authentication (MFA) adds extra account protection.

- Compliance with standards like PCI DSS and GDPR ensures legal and secure data handling.

Maximizing Value and Future Trends

To get the most from payment links:

- Track performance using KPIs like payment speed and success rates.

- Build trust through clear security communication and refund policies.

- Embrace new tech, like mobile payments, AI personalization, and blockchain for future-ready B2B transactions.

Ready to Demo Payment Links?

Payment links represent a major leap forward in B2B payment management, drastically reducing processing times while improving cash flow. Their secure, automated, and user-friendly nature minimizes administrative burdens and bolsters operational efficiency. By embracing these digital solutions, businesses not only reap immediate financial benefits but also prepare for future innovation and enhanced customer experiences. In summary, payment links are essential for any business looking to optimize its payment processes and achieve faster, more reliable cash flow. We offer one-time use payment links, invoicing and more options with our NPSONE gateway.

CLICK HERE TO FIND MORE ABOUT OUR PROGRAMS

FAQ: Frequently Asked Questions

What exactly is a payment link?

A payment link is a unique URL that directs customers to a secure online payment page where transactions are completed quickly and safely. It streamlines the B2B process by integrating invoicing systems for instant fund transfers.

How do payment links improve cash flow in B2B transactions?

They significantly reduce the payment period by enabling one-click transactions and automating invoice reconciliation, thus bringing funds in more rapidly and reducing days of outstanding sales.

Does the payment link secure enough for large B2B transactions?

Yes, they employ stringent security measures including encryption, PCI DSS compliance, tokenization, and multi-factor authentication to ensure secure payment processing.

Can I integrate payment links with my existing accounting software?

Absolutely. Most providers offer seamless integration with popular software like QuickBooks Online, automating reconciliation and updating records in real time.

What industries can benefit most from using payment links?

While beneficial across the board, industries such as SaaS, manufacturing, consulting, parts, B2B, Equipment and professional services—where lengthy payment cycles and high administrative overhead are common—see significant advantages.