Introduction

Choosing the right payment processor is a big decision for any business. Whether you operate a small retail shop, an e-commerce store, or a high-risk business, you need a reliable, secure, and cost-effective payment solution that aligns with your business model.

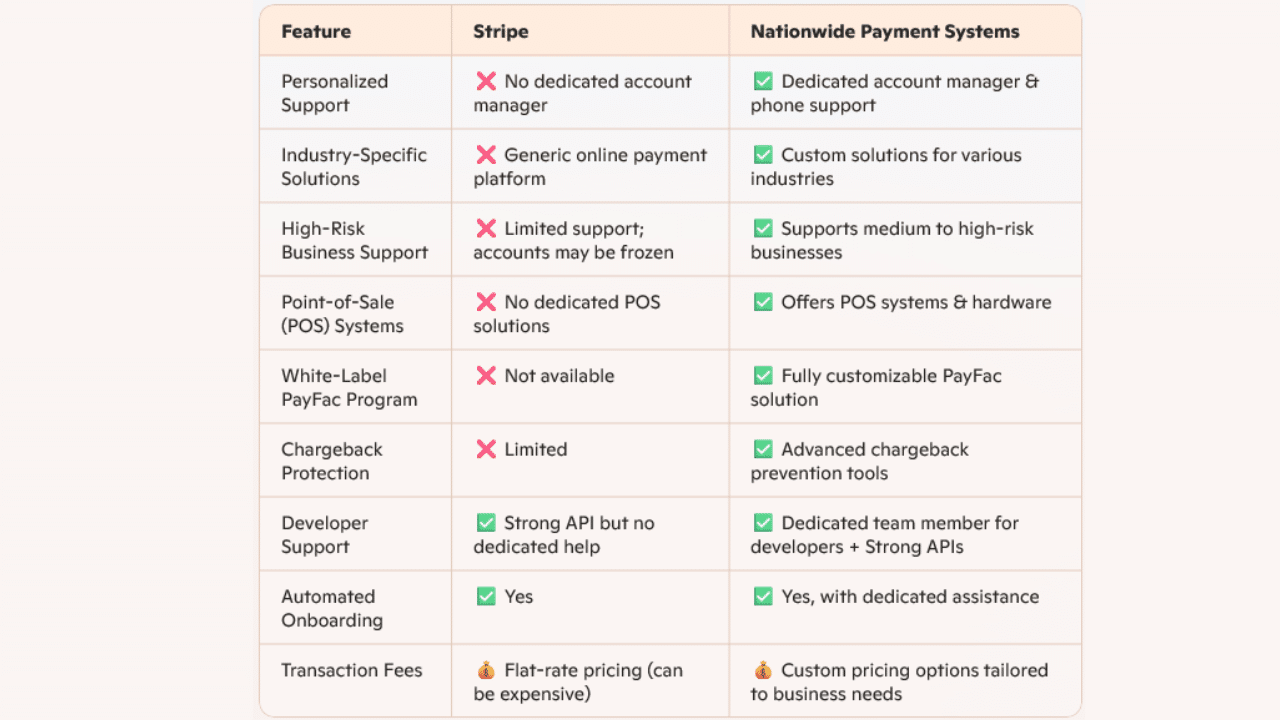

When comparing Stripe and Nationwide Payment Systems, it’s important to consider the unique features and services each provider offers. Stripe is a popular option for online businesses, while Nationwide Payment Systems stands out for its personalized service, industry-specific solutions, and support for medium to high-risk businesses.

In this guide, we will explore the details of comparing Stripe and Nationwide Payment Systems to help you decide which provider best fits your business needs.

This side-by-side table provides clarity when comparing Stripe and Nationwide Payment Systems based on key features.

Which Payment Processor is Best for Your Business?

✅ Choose Stripe If:

✔️ You run a tech-heavy, developer-focused business (SaaS, e-commerce, startups).

✔️ Your business does not require in-person payment solutions.

✔️ You are comfortable with email or online chat for customer support.

✔️ Your business does not operate in a high-risk industry.

💡 Ideal for: Tech startups, SaaS businesses, and small e-commerce brands.

✅ Choose Nationwide Payment Systems If:

✔️ You value personalized customer support with a dedicated account manager.

✔️ Your business operates in a medium to high-risk industry.

✔️ You require POS systems and in-person payment solutions.

✔️ You’re an ISV or SaaS company seeking a white-label PayFac solution.

✔️ You prefer a custom pricing structure tailored to your business.

💡 Ideal for: Retail, restaurants, automotive, healthcare, high-risk businesses, and ISVs needing a PayFac solution.

When comparing Stripe and Nationwide Payment Systems, it’s clear that NPS is better suited for businesses requiring in-person payment options and specialized support.

Final Thoughts: Which Payment Processor is Right for You?

Both Stripe and Nationwide Payment Systems have their advantages, but your decision ultimately depends on your business needs.

🚀 Choose Stripe if you’re running a tech-driven, online-only business with robust developer resources.

🚀 Choose Nationwide Payment Systems if you need high-risk approval, in-person payment solutions, or dedicated support.

📞 Ready to decide? Contact Nationwide Payment Systems today for personalized guidance!

CLICK HERE TO FIND MORE ABOUT OUR PROGRAMS

FAQ: Frequently Asked Questions

Can high-risk businesses use Stripe?

Stripe has strict policies against high-risk industries. Many businesses are approved initially but later have their accounts shut down. Nationwide Payment Systems specializes in helping high-risk businesses get approved for payment processing.

Does Nationwide Payment Systems offer online payments?

Yes! Nationwide Payment Systems offers secure online payment gateways, virtual terminals, and Invoicing, Payment Links, e-commerce solutions, just like Stripe—but with better customer support and high-risk approvals.

Can Nationwide Payment Systems integrate with my existing software?

Yes! NPS offers developer support and API integration to work with your current website, CRM, or point-of-sale system. Unlike Stripe, we assign a dedicated team member to help developers with implementation.

What High-Risk industries do Nationwide Payment Systems support?

NPS supports many industries that Stripe rejects, including:

✔️ CBD & Hemp

✔️ Subscription & Membership Services

✔️ Travel & Hospitality

✔️ Automotive Repair & Services

✔️ Adult & Regulated Industries

And many more! Check out our high-risk page for more information!

How do I get started with Nationwide Payment Systems?

📞 Contact Nationwide Payment Systems today for a free consultation and discover how we can provide the best payment solution for your business!