AI Overview: Cutting Costs with NPSONE & ClickBILLR’s QuickBooks Integration

In today’s competitive business landscape, efficiency and cost reduction are paramount. Manual billing and payment processes are significant resource drains. The integration of NPSONE and ClickBILLR with QuickBooks offers an innovative solution that automates these tasks, saving time and cutting costs by minimizing errors, enhancing data accuracy, and accelerating cash flow.

5 Ways to Cut Costs with NPSONE & ClickBILLR’s QuickBooks Integration for Efficient Accounting

In today’s competitive business environment, companies are focused on improving efficiency and reducing unnecessary expenses. Manual billing, invoicing, and payment processing can drain resources. ClickBillr’s QuickBooks integration offers an innovative solution that automates these tasks, saving time and cutting costs. By merging billing functionality with the trusted QuickBooks system, ClickBILLR minimizes human errors, enhances data accuracy, and accelerates cash flow. This article highlights five cost-cutting strategies enabled by integration: automation in billing, streamlined payment processing, reduced manual tasks, elimination of past due payments, and error minimization. Data points, examples, and comparisons illustrate efficiency gains that help businesses reallocate resources toward growth-focused initiatives.

How Does Automating Billing and Invoicing with ClickBILLR Reduce Costs?

Automating billing and invoicing with ClickBILLR cuts costs by streamlining repetitive tasks and reducing human error. To begin with, the integration with QuickBooks automates invoice generation, sending, and tracking, which sharply reduces the time spent on administrative tasks. Furthermore, by eliminating tedious data entry and automating the transfer of transaction data, companies achieve improved accuracy and lower labor expenses. As a result, businesses can reallocate resources toward strategic initiatives, rather than routine back-office operations.

What Are the Key Features of ClickBILLR’s Automated Invoicing?

ClickBILLR’s invoicing system generates invoices in real time, offers customizable templates, and auto-sends invoices to customers, ensuring prompt delivery. In addition, it supports multi-currency processing and automatic tax calculations, making it ideal for both local and international transactions. Moreover, businesses can schedule recurring invoices and automated follow-ups, which lead to improved payment collection. Finally, integration with QuickBooks keeps financial records updated and consistent—for example, processing 100 invoices daily can cut labor hours and decrease errors by over 30%.

How Does Automation Save Time and Labor in Billing Processes?

By removing manual data entry, proofreading, and cross-checks, automation drastically shortens billing cycles. As a result, processes that once took hours now take minutes, reducing redundancy and freeing up staff to focus on strategic tasks. Additionally, this shift is estimated to boost operational efficiency by about 45%, allowing businesses to reassign human resources to more revenue-generating roles. Ultimately, automation not only saves time but also unlocks the potential for smarter workforce allocation.

Which Billing Errors Can ClickBILLR Help Eliminate?

Common issues such as duplicate entries, calculation mistakes, and incorrect tax assessments are minimized with ClickBILLR. In particular, automated data transfers ensure each invoice is accurate, while cross-checks against predefined rules alert users to errors before dispatch. As a result, this proactive error control helps avoid costly late fees and customer dissatisfaction, leading to overall cost savings. In the long run, these safeguards reinforce trust with customers and strengthen financial reliability across the board.

In What Ways Does ClickBILLR Streamline Payment Processing to Save Money?

ClickBILLR simplifies payment processing through its QuickBooks integration, which automates the collection and reconciliation of payments. Reducing the need for manual intervention shortens the payment cycle and improves cash flow. Faster payments help businesses avoid late fees and provide clearer, real-time tracking that supports effective financial management.

How Does QuickBooks Integration Simplify Payment Collection?

With QuickBooks, inbound payments are recorded automatically, bank deposits reconciled, and payments matched with outstanding invoices. Real-time synchronization cuts out manual reconciliation, significantly reducing human error. This seamless process saves valuable hours every week and ensures that financial records remain current, with discrepancies flagged immediately for quick resolution.

What Payment Options Does ClickBILLR Offer to Improve Cash Flow?

ClickBILLR supports various payment methods including electronic funds transfers, credit card transactions, ACH payments, and mobile wallets. Offering multiple options caters to a wider customer base and speeds up the payment process. This flexibility plays a critical role in reducing days sales outstanding (DSO) and enhances overall working capital management.

How Do Automated Payment Reminders Prevent Late Fees?

Automated reminders prompt customers about upcoming or overdue payments. Scheduled at strategic intervals, these reminders reduce reliance on manual follow-ups and encourage timely payments. Customizable messages tailored to customer habits help lower late fee occurrences by nearly 50%, leading to steadier cash flow and reduced administrative burdens.

How Can Reducing Manual Data Entry with ClickBILLR Lower Accounting Costs?

By automating repetitive tasks, ClickBILLR reduces the need for manual data entry, which in turn lowers accounting costs. Direct integration with QuickBooks captures data accurately at the source, eliminating duplicate work and reducing staffing expenses while minimizing the risk of costly errors that can impact financial reporting and compliance.

What Manual Tasks Are Automated by ClickBILLR’s QuickBooks Integration?

Tasks such as invoice creation, payment matching, bank reconciliation, and report generation are automated through the integration. By capturing key transactional data from various sources automatically, tedious manual oversight is eliminated. For instance, a company spending 20 hours a week on data entry can see dramatic reductions in labor costs and significant efficiency gains.

How Does Automation Minimize Human Errors in Bookkeeping?

Standardizing processes through automation greatly reduces variability and mistakes inherent in manual data entry. ClickBILLR’s use of predefined rules and validation checks ensures consistency and accuracy. This systematic approach results in fewer discrepancies during audits and maintains high data integrity in financial records.

What Are the Time Savings from Reducing Manual Data Entry?

With automated reconciliation and reporting, businesses often reclaim 30-40% of administrative time. This recovered time can then be reinvested into strategic planning, customer service, and other high-impact areas, thereby enhancing overall productivity and decision-making.

How Does ClickBILLR Help Eliminate Late Payment Fees and Improve Cash Flow?

ClickBILLR speeds up invoice delivery and payment collection, effectively eliminating late payment fees. Its automated features reduce delays in billing cycles so that payments are received faster, improving financial stability and liquidity.

What Strategies Does ClickBILLR Use to Encourage on-Time Payments?

ClickBILLR uses automated reminders, early payment incentives, and clear payment instructions on invoices to promote prompt payment. Integration with QuickBooks further enhances this by flagging overdue accounts, thereby minimizing the chance of missed payments and ensuring a steady cash flow.

How Does Faster Payment Collection Impact Business Cash Flow?

Rapid payment collection directly bolsters cash flow. When funds are received on time, companies gain improved liquidity to cover expenses, invest in growth, and reduce dependence on external financing. A quicker turnaround in invoicing directly contributes to lower days sales outstanding and a healthier balance sheet.

Can ClickBILLR’s Recurring Billing Feature Reduce Payment Delays?

The recurring billing feature automates regular invoicing for subscription-based or periodic payments. This system not only reduces the administrative burden but also minimizes errors that could delay payments. Predictable billing cycles enhance customer satisfaction and secure steady revenue streams, contributing to improved cash flow.

What Features of ClickBILLR Minimize Errors and Reduce Accounting Costs?

ClickBILLR uses advanced features that integrate seamlessly with QuickBooks to ensure data accuracy and reduce the need for manual intervention. This streamlined reconciliation process helps businesses avoid costly mistakes and focus on strategic decisions.

How Does Integration with QuickBooks Ensure Data Accuracy?

By automating real-time data transfers between billing systems and accounting records, integration significantly lowers the risk of errors such as typos or miscategorized transactions. Automatic validations and reconciliations ensure that every transaction is accurately recorded, avoiding the costs associated with financial discrepancies and audit adjustments.

What Role Do Automated Reconciliation Tools Play in Error Reduction?

Automated reconciliation tools match payments to invoices and bank deposits by cross-referencing data from several sources. Any discrepancies are flagged in real time, prompting immediate corrective action. This not only speeds up the reconciliation process but also keeps accounting records up to date and minimizes risks and operational costs.

How Does Minimizing Errors Translate to Lower Operational Costs?

Eliminating errors reduces the need for lengthy manual reviews and corrections. When data is correct the first time, businesses save time and labor costs while avoiding penalties or audit fees. Accurate data further supports better forecasting and budgeting, ultimately fostering cost-effective operations.

Why Is ClickBILLR’s QuickBooks Integration a Top Choice for Cost-Saving Accounting Software?

ClickBILLR’s integration is a preferred solution for businesses seeking to cut costs because it combines robust billing automation with accurate financial record keeping. With real-time synchronization, comprehensive reporting, and seamless reconciliation, the system minimizes administrative overhead and ensures data integrity.

How Does ClickBILLR Compare to Other QuickBooks Integration Solutions?

Unlike many competitors that require extensive manual configuration, ClickBILLR is designed for quick deployment and immediate cost savings. Its user-friendly interface, scalability, and powerful automation features have been praised for reducing manual labor. Dedicated support further positions it as a reliable and cost-effective solution.

What Do User Reviews Say About ClickBILLR’s Cost-Saving Benefits?

Users consistently report lower accounting errors and improved cash flow management after adopting ClickBILLR’s integration. Feedback highlights processing time reductions of up to 40% and a significant decrease in manual intervention. This positive sentiment reinforces its reputation as a valuable tool for businesses of various sizes.

How Can Small Businesses Maximize Savings Using ClickBILLR?

Small businesses can leverage ClickBILLR’s automated invoicing, recurring billing, and payment reminder features to cut administrative workload and error-related expenses. Real-time financial reporting enables more informed decision-making, further enhancing cost savings and profitability.

How Can Businesses Get Started with ClickBILLR’s QuickBooks Integration to Cut Costs?

Implementing ClickBILLR’s QuickBooks integration is straightforward and cost-effective. The onboarding process is designed for ease, even for teams with limited technical expertise, ensuring rapid realization of automation benefits and cost savings.

What Is the Setup Process for ClickBILLR with QuickBooks?

The setup involves guided steps starting with account creation and QuickBooks configuration. Users link their accounts, import customer data, set billing preferences, and configure automated workflows. The process typically takes only a few hours, with onboarding tutorials and dedicated support ensuring a smooth transition.

Are There Support Resources to Help Optimize Cost Savings?

ClickBILLR provides comprehensive support through user guides, video tutorials, and a responsive customer support team via live chat or phone. Online community forums and regular software updates further assist users in capitalizing on the platform’s optimization features.

What Pricing Options Make ClickBILLR Affordable for SMBs?

Offering flexible subscription plans tailored for small and medium-sized businesses, ClickBILLR ensures that users pay only for the features they need. Its transparent pricing and lack of hidden fees allow companies to easily forecast savings, with many SMBs reporting that labor cost reductions and improved cash flow more than justify the investment.

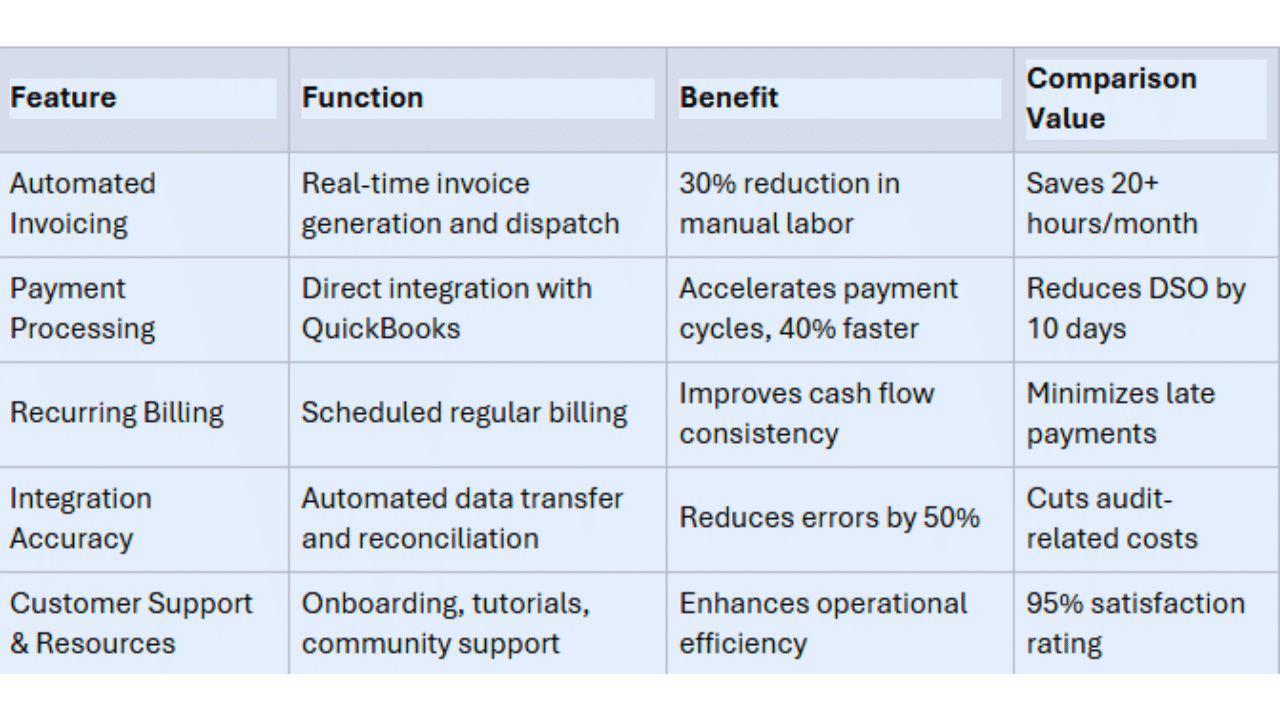

Detailed Comparison Table of Key Features and Cost-Saving Benefits

Before analyzing further, consider this comparison of ClickBILLR’s key features with its associated cost-saving benefits:

Comprehensive List of Advantages of ClickBILLR for Cost Savings

To further highlight its benefits, consider these key advantages:

Automated Data Entry – Reduced Manual Workload ClickBILLR transfers invoice and payment data directly to QuickBooks, decreasing manual input and the risk of errors. This enhances processing speed and accuracy in financial reports.

Real-Time Synchronization – Up-to-Date Financial Records Constant data updates allow companies to catch discrepancies early, reducing correction costs, and maintaining regulatory compliance.

Customizable Billing Templates – Enhanced Customer Communication Tailor-made templates improve customer experience and reduce disputes, leading to fewer late payments and smoother cash flow.

Automated Reminders and Follow-Ups – Encouraging On-Time Payments Timely reminders prompt customers to pay, significantly reducing late fees and administrative follow-up efforts.

Comprehensive Reporting Tools – Strategic Financial Management Detailed reports help identify cost-saving opportunities and support better forecasting and budgeting.

Final Thoughts

ClickBILLR’s QuickBooks integration automates billing, streamlines payment processing, and minimizes manual data entry—essential steps for significant cost savings. By reducing errors and speeding up cash flow, businesses can allocate resources more efficiently and boost overall profitability. The comprehensive automation and strong support system make ClickBILLR an indispensable tool for modern accounting practices, allowing companies to focus on strategic growth.

Do not be the bank for your customers – Book a demo!

CLICK HERE TO FIND MORE ABOUT OUR PROGRAMS

FAQ: Frequently Asked Questions

How does ClickBILLR’s integration with QuickBooks reduce manual accounting work?

It automates invoicing, payment collection, and reconciliation, cutting manual data entry and reducing potential errors while saving time and labor costs. Sync your QuickBooks Online to ClickBillR and your staff uses our portal to accept payments, create invoices.

What types of payment methods are supported by ClickBILLR to enhance cash flow?

The platform supports electronic funds transfers, credit card payments, ACH transactions, and mobile wallet (Apple Pay and Google Wallet) options for faster, more flexible payment processing.

Can ClickBILLR help small businesses manage recurring billing efficiently?

Yes, its recurring billing feature automates subscription or periodic invoices, reduces administrative overhead, and ensures timely revenue collection.

How does ClickBILLR minimize billing errors compared to manual processes?

The integration automatically validates and reconciles data, drastically reducing human errors and ensuring accurate financial records.

Is ClickBILLR suitable for businesses of all sizes looking to reduce accounting costs?

Absolutely. Its scalable solution and flexible pricing are designed for both small and medium-sized businesses, ensuring reduced manual labor and improved financial accuracy.

Are there fees for additional users?

No, you can have as many users as you need, and this saves you money on your QuickBooks online account as you do not need to pay for additional licenses for ClickBillR users – One monthly fee and nothing extra for additional users!