The Subscription Economy 2025 – Payment Solutions – FTC Click-to-Cancel Rule

Subscription-based businesses continue to thrive in 2025, as consumers embrace the convenience of recurring payments for everything from streaming services to software, fitness memberships, and even everyday essentials. Moreover, with digital commerce evolving rapidly, businesses that implement seamless, secure, and flexible subscription payment solutions gain a competitive edge by enhancing customer experience and improving revenue predictability.

The Growth of Recurring Payments

The subscription economy has seen exponential growth. Furthermore, businesses of all sizes are leveraging subscription payment solutions and recurring billing models to drive customer retention and long-term profitability. Whether offering memberships, software-as-a-service (SaaS), or curated product deliveries, companies must optimize their subscription payment solutions to minimize friction and maximize customer lifetime value. Automated billing, flexible payment options, and secure transaction processing are now essential components of a successful subscription-based business.

Payment Solutions for Subscription Businesses

To maintain a seamless payment experience, businesses must ensure their subscription payment solutions and payment processing systems support various features, including:

- Automated Recurring Billing: Firstly, this feature reduces manual invoicing and ensures timely payments.

- Multiple Payment Methods: Moreover, credit cards, ACH payments, and digital wallets cater to diverse consumer preferences.

- Dunning Management & Payment Recovery: Similarly, automated reminders and card update services help reduce involuntary churn.

- Security & Compliance: Specifically, tokenization, encryption, and PCI DSS compliance protect sensitive payment data.

- Customer-Centric Billing: Above all, flexible billing cycles, proration, and self-service portals improve user experience.

By implementing subscription payment solutions, businesses can reduce churn, enhance customer satisfaction, and scale their subscription-based revenue streams.

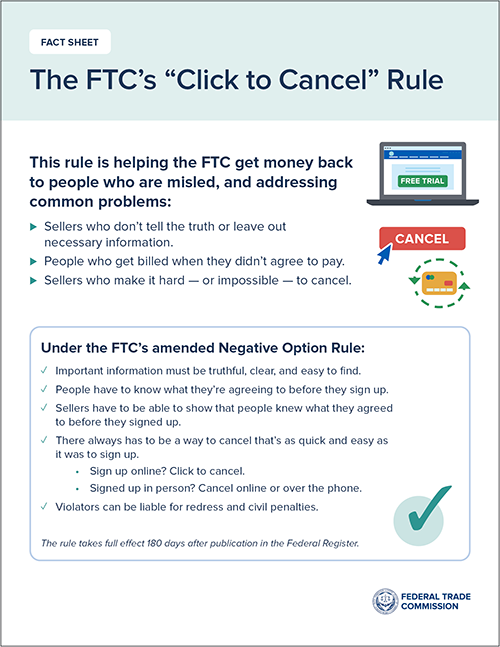

The FTC’s New Click-to-Cancel Rule and Its Impact

In 2025, the Federal Trade Commission (FTC) introduced new “Click-to-Cancel” rules aimed at simplifying subscription cancellations. As a result, this regulation requires businesses to make the cancellation process as easy as signing up, allowing users to terminate their subscriptions with a single click or similarly effortless action. Additionally, companies must clearly disclose renewal terms and obtain explicit consent before re-enrolling customers.

For subscription-based businesses, these regulations underscore the importance of transparency and consumer trust. Hence, companies must review their cancellation policies, ensure compliance with the new FTC standards, and optimize their subscription payment solutions and management platforms to maintain customer loyalty while adhering to regulatory changes.

Card Brands and Contract Enforcement

It is important for businesses to understand that credit card companies and card brands do not enforce contracts between merchants and customers. On the other hand, if a customer cancels a recurring transaction or disputes a charge, the business cannot rely on the credit card company to uphold their contractual agreements. Instead, businesses must take legal action, such as pursuing the matter in court, if necessary.

To protect against disputes and cancellations, businesses should adopt the following best practices:

- Obtain e-signatures on contracts, invoices, and credit card authorization forms.

- Require customer signatures for both one-time and recurring charges.

- Ensure cancellation policies are clearly visible, in bold letters, and positioned within one inch of the customer’s signature.

- Moreover, have customers initial key terms, including billing cycles and cancellation policies, reinforcing acknowledgment and agreement.

By implementing these measures alongside optimized subscription payment solutions, businesses can safeguard their revenue and reduce the risk of chargebacks and disputes.

Future-Proofing Subscription Payment Models

All things considered, as the subscription economy continues to evolve, businesses must stay ahead of regulatory updates, technological advancements, and shifting consumer expectations. Offering frictionless payments, robust security measures, and enhanced customer flexibility through innovative subscription payment solutions will be key to thriving in this dynamic landscape.

Whether you are launching a new subscription service or optimizing an existing one, partnering with a reliable subscription payment solutions provider ensures you stay competitive in 2025 and beyond.

Get a Compliance Review Today

In summary, navigating the complexities of subscription payments and FTC regulations can be challenging. At Nationwide Payment Systems, we offer a comprehensive review of your paperwork, website, and procedures to ensure compliance with the latest industry standards. Contact us today to safeguard your business, enhance customer satisfaction, and optimize your subscription payment solutions strategy.

CLICK HERE TO FIND MORE ABOUT OUR PROGRAMS

FAQ: Frequently Asked Questions

What are subscription payment solutions?

Subscription payment solutions are systems designed to automate and manage recurring billing processes for businesses that offer subscription-based services. They help ensure secure transactions, timely payments, and customer satisfaction.

What are the benefits of using subscription payment solutions for businesses?

-

Streamlined payment processes

-

Improved revenue predictability

-

Reduced manual invoicing

-

Enhanced customer retention through flexible billing options

What features should subscription payment solutions offer?

Key features include automated recurring billing, multiple payment methods, secure transaction processing, dunning management, and customer self-service portals.

How does the FTC Click-to-Cancel Rule impact subscription-based businesses?

The FTC Click-to-Cancel Rule requires businesses to simplify subscription cancellation processes. Customers should be able to cancel subscriptions as easily as they sign up, with clear disclosure of renewal terms and explicit consent for re-enrollment.

What steps can businesses take to ensure compliance with the FTC Click-to-Cancel Rule?

-

Simplify the cancellation process

-

Disclose renewal terms clearly

-

Obtain explicit customer consent for re-enrollment

-

Review subscription management systems for regulatory compliance