Understanding the MATCH List and Its Impact on Merchants

The MATCH List, also referred to as the Terminated Merchant File (TMF), is a crucial database shared globally among banks, payment processors, and card networks such as Mastercard and Visa. While it acts as a risk management tool, being placed on this list can have serious consequences for businesses. Therefore, it’s essential to understand how it works and how to avoid it.

What Is the MATCH List?

MATCH stands for Member Alert to Control High-Risk Merchants. It is used to flag businesses that banks and processors consider high-risk. For example, merchants are often placed on this list if their accounts are terminated due to fraud, excessive chargebacks, or non-compliance with regulations. In other words, it serves as a warning system for financial institutions to identify businesses that might pose a risk.

Once listed, the information remains in the database for five years unless the acquiring bank that added the merchant decides to remove it. However, such removals are rare, and businesses may face significant challenges during this period.

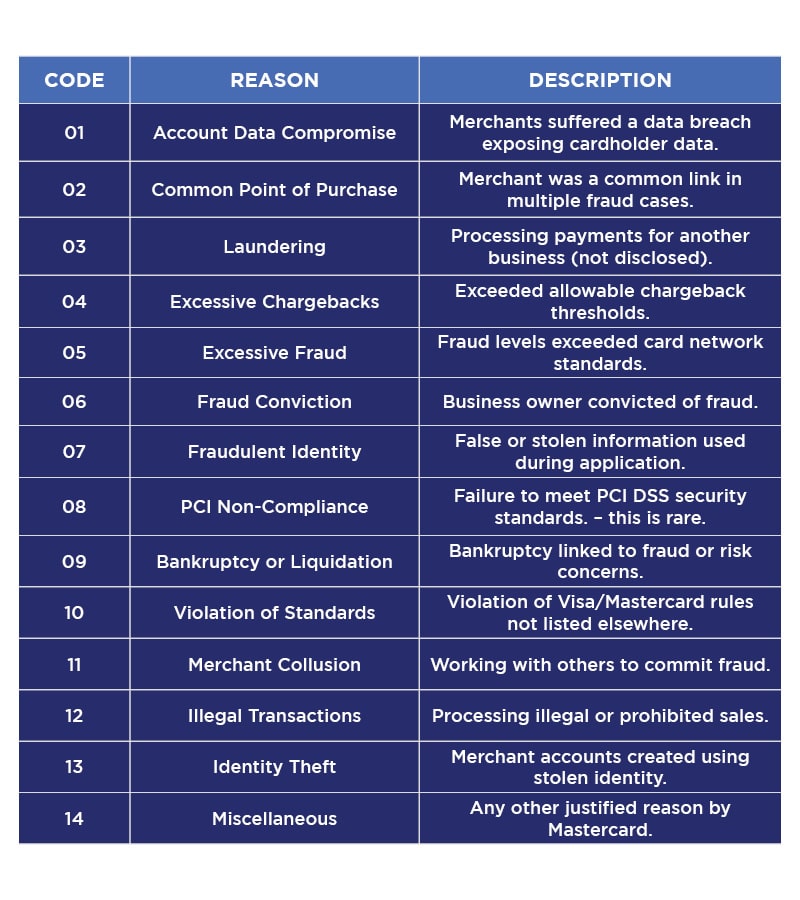

14 Reasons You Can End Up on the MATCH List

Here is a breakdown of the official MATCH List Reason Codes used by Mastercard:

Why Does This Matter for Business Owners?

Being placed on the MATCH List can greatly impact your ability to accept credit card payments. For instance, businesses often struggle to secure new merchant accounts and must resort to high-risk payment processors, which typically charge higher fees. Moreover, they may face stricter contract terms and reduced flexibility.

As a result, it becomes crucial for business owners to recognize and address the factors that lead to being placed on this list. By doing so, they can safeguard their operations and avoid the long-term consequences.

What to Do If You’re on the MATCH List

If you find yourself on the MATCH List, don’t panic. Instead, take the following steps:

– Identify the Cause: Determine why your account was terminated and what led to your listing. This step is important because understanding the issue is the first step toward resolving it.

– Reach Out to the Processor: Contact the payment processor that placed you on the list. They may provide guidance on how to rectify the problem. In some cases, resolving compliance or operational issues can improve your situation.

– Work with High-Risk Processors: While it may be challenging, high-risk payment processors can provide temporary solutions to keep your business running. Additionally, consider consulting legal or financial experts who specialize in MATCH List cases.

How to Avoid the MATCH List

Ultimately, prevention is better than cure. To reduce your risk, follow these best practices:

– Keep chargeback rates low. For example, using a chargeback monitoring service can help.

– Be transparent with your payment processor and notify them of any changes in your business model. Otherwise, unapproved activities could lead to violations.

– Always follow PCI compliance rules and avoid processing payments for other businesses.

By adopting these habits, you can minimize the chances of being flagged as a high-risk merchant.

Final Thoughts

The MATCH List can pose significant obstacles to businesses, but it’s not the end of the road. With persistence and a proactive approach, it’s possible to address the issues that led to your listing and move forward. Remember, maintaining good processing habits and open communication with your payment processor are key to staying on track.

CLICK HERE TO FIND MORE ABOUT OUR PROGRAMS

FAQ: Frequently Asked Questions

What is the MATCH List or TMF?

The MATCH List (Member Alert to Control High-Risk Merchants), also known as the Terminated Merchant File (TMF), is a database managed by Mastercard and used by Visa. It lists merchants whose accounts were terminated for serious violations like fraud, excessive chargebacks, or PCI non-compliance.

How long does a merchant stay on the MATCH List?

Merchants remain on the MATCH List for 5 years from the date of placement unless the acquiring bank that placed them on the list agrees to remove them — which is extremely rare.

Can a merchant get off the MATCH List?

Yes, but it is very difficult. Typically, only the processor or acquiring bank that placed the merchant on the list can request removal. This often requires proving the reason for placement was incorrect or has been fully resolved.

How do I know if my business is on the MATCH List?

Merchants usually find out when applying for a new merchant account and getting denied. You can request information from the acquiring bank that placed you on the list or work with a high-risk merchant account provider like Nationwide Payment Systems to assist with the process.

We can provide you with the email address so you can send an email and find out why you are on the MATCH list and who put you there and the reason?

What should I do if I am on the MATCH List?

- Contact the processor that placed you on the list.

- Determine the reason code.

- Resolve the issue if possible.

- Work with a high-risk payment processor experienced in MATCH List cases, like Nationwide Payment Systems.

- Can you get a merchant account if you are on MATCH?

In some circumstances you can get a processor who holds full liability to grant an exception. This is not easy to get done but we have accomplished this in many cases under the right circumstances.

We specialize in High Risk and Niche merchant accounts getting approved for business owners.